Adding Existing Tax1099 Payers and Vendors

To add existing Tax1099 Payers and Vendors, perform the following steps:

1. Navigate to the Zenwork Payments platform.

2. Click Tax1099.

The Tax1099 Payers and Their Associated Vendors page appears.

3. Select the payer(s) you want to import from Tax1099.

4. Click the payer's name to expand and view the list of associated vendors.

5. (Optional) Under Payers and Vendors, correct any incorrect information or fill in the missing details by clicking the  Edit icon.

Edit icon.

6. (Optional) Turn on the Show Rows with Errors toggle to view the payer and vendors with pending fixes.

7. Click Import.

The Confirmation dialog box appears.

8. Click Proceed.

The Select Payers page appears.

9. Select the payers you want to import.

10. (Optional) Click to expand Add Payer, and then select the appropriate option to add or import payers manually.

11. Click Next.

The Select Vendor page appears, displaying the selected Payer(s) with the list of associated Vendors.

12. Select the vendor(s) you want to add, and then click Next.

13. Select the payer(s) you want to subscribe, verify the details, and then click Next.

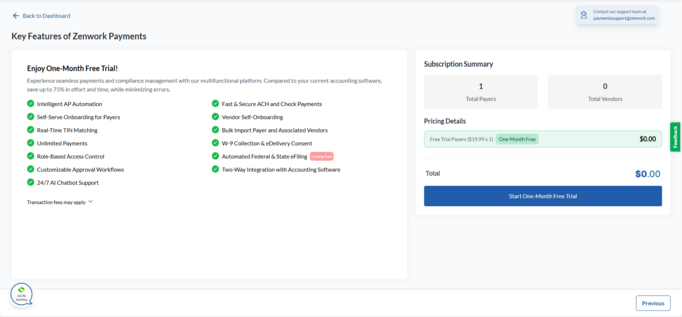

The Subscription Summary page appears.

14. Verify the subscription fee details and click Start One-Month Free Trial.

Note:

-

Start One-Month Free Trial appears for newly added payers who haven’t subscribed before, as well as for re-subscription payers.

-

Proceed to Pay appears when previously unsubscribed payers are manually added back for re-subscription.

The Set Up Your Payment page appears.

15. Select a credit card from the available cards or click Add New Card to add a new one.

16. Select an address from the available addresses or click Add New to add a new address.

17. Read the terms, select the check box, and then click Subscribe Now.

The Payers dashboard appears, displaying a list of added payers and their associated vendor count.